The Sales Revenue Formula: How to Use It and Why It Matters

But some companies routinely derive additional revenue from their business operations. Sales Returns and Allowances and Sales Discounts are contra-revenue accounts. Next, subtract interest expenses from the operating margin to find pretax income.

They can increase your total number of sales, resulting in higher sales revenue. Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase.

Costs Affecting Net Sales

However, some companies report gross and net sales both on the income statement itself. The table below shows an excerpt from a sample income statement. Any money coming in from outside of core business operations (selling products and services) is considered nonoperating income and is included in revenue but not sales.

These include the would-be buyer’s initial contact with a realtor and meeting with a representative at a lending institution to obtain financing in the form of a mortgage. When people ask the question “What is a sale?” their inquiry may involve the ways to pay. In general, there are three main ways to make the payment of money required in a sales transaction. To complete a sale, both the buyer and seller must be deemed competent. The good or service in question must be legally available to buy and the seller must have the authority to transfer the item to the buyer. In the financial markets, a sale can also refer to an agreement that a buyer and seller make regarding a financial security, its price, and specific arrangements for its delivery.

- Sales revenue has earned its position at the top line of all income statements.

- For instance, sale revenue of a business whose main aim is to sell biscuits is income generated from selling biscuits.

- Sale revenue must result in increase in net assets (equity) of the entity such as by inflow of cash or other assets.

- Access and download collection of free Templates to help power your productivity and performance.

- Recording the sales process by Amanda White is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

It’s also important to distinguish between sales and revenue, because some revenue sources may be one-off events. Now all that is happening in the business is that we are transforming one asset (Accounts Receivable) into another (Cash). The equation is balanced because the total change in assets is $0 and the change in liabilities and equity is also $0. Companies will typically strive to maintain or beat industry averages. Allowances are typically the result of transporting problems which may prompt a company to review its shipping tactics or storage methods. Companies offering discounts may choose to lower or increase their discount terms to become more competitive within their industry.

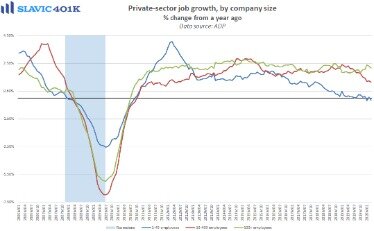

How B2B Sales Teams Can Restore Their Pipelines in 2020

At that point, the seller would indicate the total amount of money required for the purchase. The buyer would provide payment and then take possession of the item. A sale occurs when a seller of goods or services transfers ownership of, and title to, a good or service to a buyer in exchange for a specific amount of money or other specified assets. To complete a sale, both the buyer and the seller must agree to the specific terms of the transaction.

As the first item listed on a financial statement, it becomes the pivot or anchor from which other line items are proportional to. Both show the operational costs that go into producing a good or service. If cost of sales is rising while revenue stagnates, this might indicate that input costs are rising, or that direct costs are not being managed properly. Cost of sales and COGS are subtracted from total revenue, thus yielding gross profit.

- Gross sales revenue is the total of all sales of goods and services without taking into account any returns, discounts, or allowances.

- A sales return is usually accounted for either as an increase to a sales returns and allowances contra-account to sales revenue or as a direct decrease in sales revenue.

- “Outstanding orders” refers to sales orders that have not been filled.

- In cash accounting, the revenue is only recorded if the money has actually been received for the goods or services delivered.

The income statement is the financial report that is primarily used when analyzing a company’s revenues, revenue growth, and operational expenses. The income statement is broken out into three parts which support analysis of direct costs, indirect costs, and capital costs. The direct costs portion of the income statement is where net sales can be found. Most companies directly report the net sales numbers, and the derivation is given in the notes to the financial statements.

What are Net Sales?

Many companies working on an invoicing basis will offer their buyers discounts if they pay their bills early. One example of discount terms would be 1/10 net 30 where a customer gets a 1% discount if they pay within 10 days of a 30-day invoice. Sellers don’t account for a discount unless a customer pays early so notations must be retroactive. The double entry is same as in the case of a cash sale, except that a different asset account is debited (i.e. receivable).

Companies that allow sales returns must provide a refund to their customer. A sales return is usually accounted for either as an increase to a sales returns and allowances contra-account to sales revenue or as a direct decrease in sales revenue. As such, it debits a sales returns and allowances account (or the sales revenue account directly) and credits an asset account, typically cash or accounts receivable. This transaction carries over to the income statement as a reduction in revenue. Some companies allow their customers to purchase products or services and make installment payments until the bill is paid.

Non-Operating Revenue

Net sales do not account for cost of goods sold, general expenses, and administrative expenses which are analyzed with different effects on income statement margins. Typically, a company’s income statement highlights the net sales figure. In some cases, companies will choose to report both gross and net sales, but they will always be displayed as separate line items.

Thomson Reuters’ profit beats estimates; outlook steady – Reuters

Thomson Reuters’ profit beats estimates; outlook steady.

Posted: Wed, 02 Aug 2023 15:15:00 GMT [source]

That is, the business has regular customers that it trusts to sell goods and receive payment at a later date. That later date is usually within 30 days, though in some industries it can be up to 90 days. The word “sales” is commonly used for all types of income generating sources not just sales of products. Services, rental income, and commissions are often called sales on companies’ books. In general, the word “sales” usually refers to a company’s revenue or income. ” However, offering discounts results in major benefits, like increased sales and customer loyalty.

If a buyer complains that goods were damaged in transportation or the wrong goods were sent in an order, a seller may provide the buyer with a partial refund. A seller would need to debit a sales returns and allowances account and credit an asset account. This journal entry carries over to the income statement as a reduction in revenue. For companies using accrual accounting, they are booked when a transaction takes place.

The receipt of payment from the customer is not relevant to the recognition of sale since income is recorded under the accruals basis. Gross sales are calculated simply as the units sold multiplied by the sales price per unit. The gross sales amount is typically much higher, as it does not include returns, allowances, or discounts. The net sales amount, which is calculated after adjusting for the variables, is lower.

Each transaction lists the date the transaction occurred and a description to the left of the number column. The number listed represents an increase in “Cash” and an increase in “Sales.” Net sales is equal to gross sales minus sales returns, allowances and discounts. Net sales is what remains after all returns, allowances and sales discounts have been subtracted from gross sales.

Recording the sales process

For companies using cash accounting they are booked when cash is received. Some companies may not have any costs that will require a net sales calculation but many companies do you know the pulse of your team do. Sales returns, allowances, and discounts are the three main costs that can affect net sales. All three costs generally must be expensed after a company books revenue.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Recording the sales process by Amanda White is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

The accounting equation balances because it is increasing by $350 on both sides. Nurture and grow your business with customer relationship management software. The Merriam-Webster dictionary defines a sale as the transfer of ownership of, and title to, property from one person to another for a price. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Take your learning and productivity to the next level with our Premium Templates.